Are you looking to file KRA Returns on the KRA Portal but are unemployed? Find out how to use the KRA Portal to file KRA returns if you are unemployed.

If you are unemployed but have a KRA PIN number, you should be aware that the Kenya Revenue Authority (KRA) has set a deadline for you to file your KRA returns via the KRA Portal on or before June 30th every year. Therefore, those who fall under the Kenyan unemployment group must file their KRA Tax Returns via the KRA Portal.

(Section 52B of the Income Tax Act, Cap. 470) Everyone with a current KRA PIN Number is required by law to file their returns. Failure for which there is a penalty. Those who are unemployed must submit their KRA Returns on the KRA Portal before the deadline has passed. Simply put, the phrase “not employed” signifies that you have a KRA PIN Number but no work or are not currently employed.

READ ALSO: Student KRA Return Filing Procedures

There is an outdated belief that only individuals in employment file KRA Returns. This is not true; whether you are working or not, as long as you have a KRA PIN, you must file your KRA returns by the deadline set by the Kenya Revenue Authority (KRA).

I’ll be sharing with you the method and step-by-step instructions for filing KRA returns using the KRA Portal if you’re unemployed in this article. Therefore, if you are unemployed, that is, have no other source of income, and need to file KRA Returns for Unemployed on the KRA Portal, this article will walk you through all the necessary steps you must take in order to do so before the Kenya Revenue Authority (KRA) deadline of June 30 expires.

It’s not very difficult to file KRA Returns for Unemployed, and this is made much simpler if you have on hand the essentials needed before accessing your KRA Portal account. You must make sure you have your KRA PIN number and KRA password, which are required to access the KRA Portal, on you at all times. Once you have the two credentials, you can easily follow the step-by-step instructions provided in this article on how to file KRA returns using the KRA Portal if you are unemployed.

Requirements Needed to File KRA Returns If Not Employed

There are a few things you need to make sure you have in order to be able to file KRA Returns If Unemployed on the KRA Portal. The KRA PIN number and KRA password are part of this. These two are crucial because without them, you won’t be able to log into the KRA Portal or submit your KRA Return for Unemployment.

You will need your KRA PIN Number and KRA Password, which together make up the most crucial KRA Portal login credentials, to be able to file KRA Returns using the KRA Portal if you are not currently working. Here, we’ll take a quick look at each of these essential elements.

1. KRA PIN Number

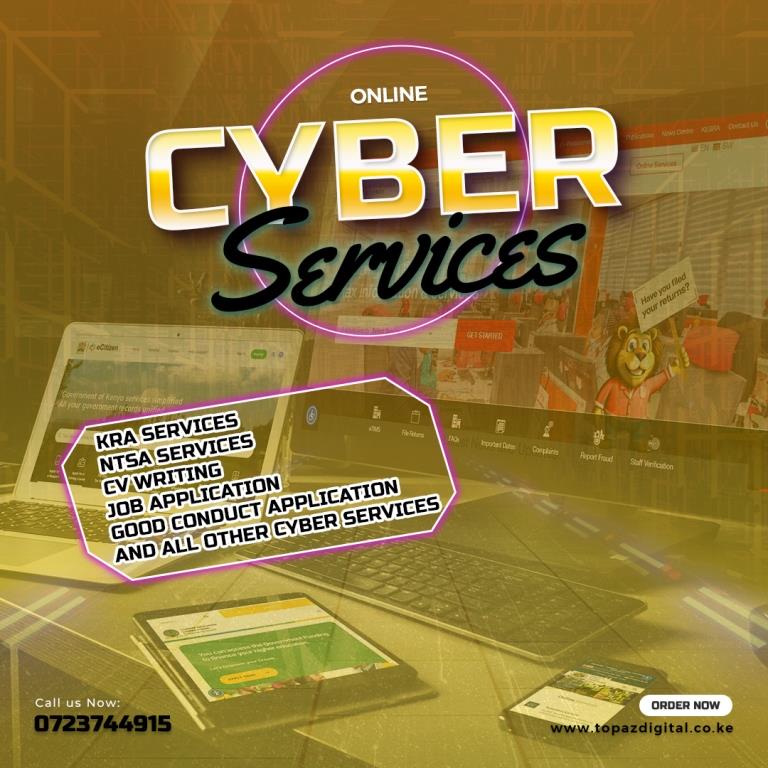

The most crucial item you must have with you is a KRA PIN Number. If you have ever lost or forgotten your KRA PIN, you can submit a KRA PIN Retrieval order online at the cyber.topazdigital.co.ke Portal, and a member of our team of professionals will be able to help.

At the same time, if you need a new KRA PIN, you can register for one right now at the cyber.topazdigital.co.ke Portal and receive it in 3 minutes. Once our Support team has completed and processed your request for PIN registration, your KRA PIN Certificate will be provided to your email address.

2. KRA Password

Your KRA Password is the next thing you need to have on hand. To access your KRA Portal Account, you must have your KRA Password. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA Password. Once you’ve requested a password reset, you’ll receive an email with a new password that you may use to access your KRA Portal account.

If the email address used in the KRA iTax Portal is the same as the one you now have, you can only update or reset your KRA password. You can submit a KRA PIN Change of Email Address order online at the cyber.topazdigitalco.ke Portal if you can’t remember it or if you need to change your email address in order to reset your KRA password.

Procedures For Filing KRA Returns If Unemployed

1. Go to the KRA Portal.

You must visit the KRA Portal as the first step in the procedure for filing KRA returns if you are unemployed. You can get to the KRA Portal by clicking on https://itax.kra.go.ke. A new browser tab will be opened when you click the link.

2. Enter the KRA PIN number.

You must input your KRA PIN number on this step. If you’ve lost your KRA PIN, you can request its retrieval through the cyber.topazdigital.co.ke Portal, and it will be provided right away to your email address. To move on to the following stage after entering your KRA PIN, click the “Continue” option.

3. Enter your KRA password and answer the arithmetic question (security stamp)

You must complete this stage by entering your KRA Password and answering the arithmetic question (security stamp). You can read our post on how to reset your KRA password if you’ve forgotten it. You will receive a new password via email, which you can then use to log in. To access your KRA Portal Account after entering your iTax Password, click the “Login” option.

4. Account Dashboard for KRA Portal

As shown in Step 3 above, after entering the proper KRA password and answering the arithmetic question (security stamp), you will be successfully logged in and have access to your KRA Portal Account Dashboard. We go on to step 5 because we are submitting KRA Returns via the KRA Portal for individuals who are unemployed.

5: Select File KRA Nil Return from the Returns Menu Tab.

In this stage, select “File KRA Nil Return” from the drop-down menu list on the “Returns” menu tab of the iTax Account menu list. The screenshot below serves as an illustration of this.

6. Choose Tax Obligation As Income Tax Resident Individual

Since we are completing a KRA Return for Unemployment, choose Income Tax Resident Individual under the Tax Obligation section of the KRA Returns Form. The system automatically pre-fills Type and Taxpayer, the other two fields.

7: Complete the Individual KRA Returns for Residents of Income Taxes form.

You must choose the date for the Return Period From section in this step on the KRA Returns Form. We are filing KRA Returns for 2020 for Unemployed Persons while we are in 2023. As a result, the system will automatically pre-fill the Return Period To date to be 31/12/2022 and the Return Period From date to be 01/01/2022.

You can submit the KRA Return for Unemployed to Kenya Revenue Authority (KRA) by clicking the “Submit” button after entering the returns dates 01/01/2022 – 31/12/2022 on the KRA Returns form. Itax.kra.go.ke will notify you via a pop-up window, as illustrated below:

8. Download the KRA Returns Acknowledgement Receipt.

The KRA Returns Acknowledgement Receipt for Unemployed that has been successfully generated by the iTax system (KRA Portal) must be downloaded in this final stage. This is a definitive confirmation that the Kenya Revenue Authority (KRA) has received your KRA Return for Unemployed satisfactorily. Additionally, a receipt number will be generated for the KRA return that we recently submitted via the KRA Portal.

The KRA Returns Receipt for Unemployed (Not Employed) is provided below and serves as a final assurance that the KRA Returns were successfully submitted via the KRA Portal. Your KRA Portal registered email address will also receive the identical acknowledgement receipt.